With a cremation rate at 60% and growing, we thought it was time to reflect on some important things that could affect cremation costs in 2024 and the continued demand for direct cremation services.

Why has cremation become the popular disposition choice for families?

Several reasons are cited for why cremation has become more popular as a funeral option: a demand for greater flexibility for migrated families, a decrease in religious attitudes, the belief that cremation is more environmentally friendly than traditional burial, and the significantly reduced cost of cremation as opposed to burial.

By far, I would propose that cost is the primary driver for the growth of the cremation rate. Opting for a direct cremation saves families from the burden of an expensive funeral. A cremation service reduces funeral costs by at least 40%.

If a family opts for a low-cost direct cremation service, they can often keep funeral costs below $1,000. If cost is indeed the primary driver for the shift to cremation, will the demand for cremation services remain the same if cremation costs increase in 2024?

Continuing changes and challenges we face in our modern world have also served to help escalate cremation as a funeral alternative.

Click here to find out how much direct cremation costs near you.

#1 Has COVID & social restrictions affected the funeral ritual?

Our world has changed profoundly since 2020, and COVID-19 restrictions dramatically affected our notion of the funeral ritual. For many months, families simply could not hold a funeral gathering, and in some cases, even attending a funeral home for a funeral arrangement consultation was prohibited.

Some families ended up with no choice other than to arrange a cremation to take care of the disposition of their loved ones. Some funeral homes were already positioned to meet these challenges, while others did adapt quickly to this radical change in their industry.

Adopting technology at a speed not witnessed before, where online arrangement, electronic signatures, and electronic filing of documents have now become a new contactless means of arranging a cremation.

So, it could be said that the pandemic has altered the funeral ritual and increased the cremation rate.

#2 Is the cost of cremation likely to change in 2024?

Yes, I forecast that the cremation cost will likely increase this year. The cost of cremation services, especially low-cost direct cremation, could be considered a key reason for the shift from traditional funeral services to cremation as an affordable alternative.

In many cities, a direct cremation can be conducted for less than $800, and many cremation service providers report that 70% of the cremations they perform are indeed direct cremations.

At US Funerals Online, we had already witnessed cremation price increases in several areas in 2023. Some were small increases of $25.00; others hiked their basic cremation price by $100 or more.

Read on to learn more about why cremation prices may rise in 2024

#3 What impacts cremation prices and the funeral industry?

In the last 6 months, we have seen a subtle increase in cremation prices. Some budget cremation providers report profit margins being squeezed as overhead costs increase. Below, we will explore the key changes impacting cremation costs.

Increase in Gas Prices

The most significant overhead cost increase has been the rise in gas prices. This affects the cost of performing a flame cremation in gas retorts and the transport costs for collection services.

Church Funeral Services in Louisiana (which operates its own crematory) had to raise its direct cremation price when the supply cost of its natural gas increased by 50%, and the price per gallon for filling its transport fleet increased from $2.00 to $3.00.

Other funeral homes in the DFS Memorials network of affordable cremation providers have experienced the same, and we have seen price increases in several states.

County Budgets & Increases in Permits

It has been widely reported that many counties are struggling to manage budgets to deliver all the required public services. For a cremation to proceed, the county coroner or Medical Examiner’s office must provide a permit. Before the demand for cremation grew to today’s level, many counties provided these permits at little or no charge.

As cremation grew in popularity, permit fees were introduced and/or increased. These permit fees vary hugely by state and county, but these fees are doubling in some counties. This has an impact as this cost has to be recouped, and some funeral homes that included a small permit fee in a cremation service package are now forced to increase their price.

Competition for the Cremation Market & Acquisitions

As we explored in our article An Industry in Change: How Cremation is becoming the Nation’s Preferred Funeral Option competition for the booming cremation market created cremation ‘price wars’ in some areas. Those funeral companies with the resources and deeper pockets could afford to drive down the price in an area and force other small funeral homes out of business.

The shift from a traditional funeral to cremation was already hurting many small funeral businesses. When a typical funeral case has declined from $10,000 to $3,000 (or lower), many funeral businesses are coping with a significant drop in revenue, and the only way to combat that is to increase the volume of cremation cases.

We are witnessing an era of acquisition by larger funeral companies. Foundation Partners Group has strategically invested in acquiring funeral businesses with a strong cremation portfolio, adding 8 new brands and 25 locations in 2020 alone.

With a growing network of locations (230 locations in 21 states), they are also heavily investing in and developing their online direct cremation brand, Tulip Cremation. This allows them to enter local cremation markets without the overhead of a brick-and-mortar set-up.

Acquisition and innovation, such as we see from Foundation Partners Group (FPG), may initially be a positive for the cremation consumer but ultimately could lead to a control of the cremation market in certain locales. At that point, the lack of competition could lead to control over the cremation price point.

Direct-to-Consumer Online Market Growth

In addition to acquisition, a significant growth area in the last two years, which continues into 2024, is the launch of new online cremation brands targeted directly to cremation consumers, who will complete the whole transaction process online and/or by phone.

Brands similar to FPG’s Tulip Cremation have sprung up, including tech companies as well as funeral businesses. After Services Inc. launched in six states, Eirene Cremations originally launched in Canada but now targets the U.S. direct cremation market.

Supply Issues for Funeral Homes Planning Installation of a Crematory

During 2020-2022, we all became aware of supply chain issues. The Funeral Home & Cemetery News reported a ‘Delay in Cremation Systems Installations Expected’ across the nation as price increases and supply chain issues impacted the schedule for materials and the planned budgets for installations.

If the planned expansion of crematory facilities nationwide stalls, this delay in new installations could likely affect cremation prices into 2024 and 2025. Many funeral homes will continue to be without cremation equipment and dependent on trade services, which could affect the continued demand for existing crematories, especially as the cremation rate is forecast to keep growing.

Will families consider green eco alternatives to reduce the carbon impact of flame cremation?

This is an interesting question. The current climate agenda and rising gas prices could both serve to re-align our attitudes to death care options. As posited at the start of this article, the cost has been the determining factor in the shift to cremation services.

If gas prices force cremation costs up, will we consider other alternatives?

A recent National Funeral Directors Association (NFDA) survey reported that 72% of funeral homes reported increased interest in green burial options. The average cost of a natural burial is around $3,000. Less expensive options exist, but due to the current low demand, natural burial sites must charge fees to maintain perpetual care.

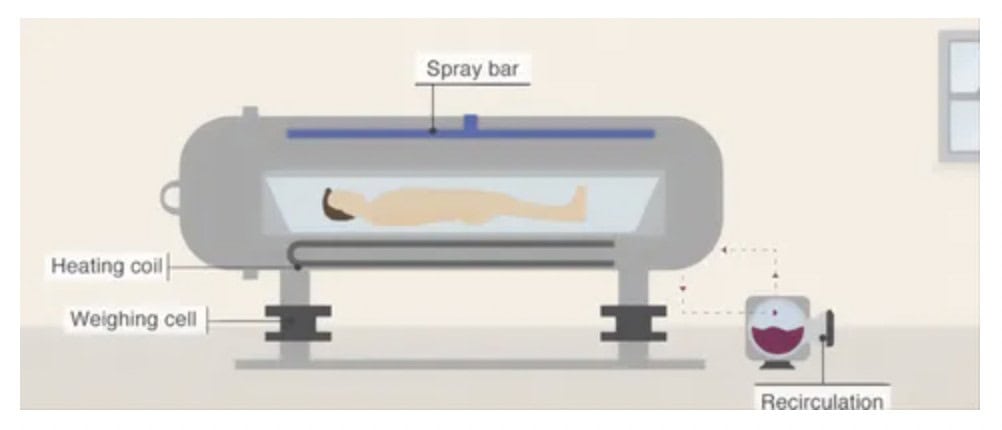

Other eco-disposition alternatives exist. Aquamation (alkaline hydrolysis) has largely been extremely niche for human disposition but is legal in some 22 states as of 2024.

This low carbon-producing alternative to flame cremation can be conducted for between $1,295 and $3,500 (depending on the location), potentially offering a reduced-cost disposition. Again, should demand increase, we should see more funeral service providers offer the option.

We have observed several new locations launch in the last 12 months, so it does seem that some progressive funeral and cremation businesses are looking to a future where water cremation will be more in demand. They may also position their business as the known aquamation provider to serve an area ahead of a trend shift.

Human composting, also called Natural Organic Reduction (NOR), has now been legalized in Washington, Colorado, Oregon, New York, California, and several other states are considering passing legislation. However, costs and availability limit access to this as a death care alternative.

In conclusion, I think we may witness some changes in the cremation market throughout this year and into 2025, whether price changes, further acquisition of the market, or the beginning of a growing interest in greener alternatives.

Further reading: